Eneco market reports Mid-April 2022

Russian conflict with Ukraine

Having reacted to news about sanctions, the market has been fairly stable although volatility does remain and the market is still headline reactive. There appears to be no progress with talks aimed at ending the conflict, and certainly Putin is showing no signs of willingness to bring it to an end.

Electricity costs:

The UK government finally unveiled its energy security strategy – mainly focused on generation – with the key feature a commitment to the development of up to 24 GW of new nuclear capacity across eight plants. The strategy also includes targets for increasing offshore wind capacity. A key component is the government hope to speed up approval processes from 4 years to 1.

Limited renewable output early in the month saw prices increase whilst warmer weather has helped improve the situation. The current increased winds and a drop in gas demand should support a better market although there is a forecast drop in temperatures next week.

For more information see our full market update via the link below.

Outlook:

- From April 29th 425 MW will be taken offline at the gas-fired Grain power plant for work expected to last until May 22nd, according to operator Uniper.

In July the 965 MW Hinkley Point B nuclear reactor is due to close, having been operational since 1976. - Shell and Uniper have teamed up to develop a 720 MW blue hydrogen facility – using reformed natural gas and carbon capture and storage to produce the fuel – at the UK-based Killingholme power plant. A final investment decision on the project is expected in 2024 with the potential for production to commence at the site in 2027, according to the companies.

- A new body will be created to oversee the energy network with a key focus on the transition towards net zero, it was announced in early April. The ‘future systems operator’ will be publicly owned and will take on the main responsibilities for manging the electricity network that are currently carried out by National Grid, as well as some of the gas oversight functions.

- A £375m fund was launched to support the UK energy transition – including £100m to cover the difference between hydrogen production costs and the sale price as part of a £240m hydrogen package – in combination with the release of the energy security strategy. Other technologies that will be supported include carbon capture and storage (CCS).

Gas costs:

Members of the European Parliament (MEPs) voted to ban the import of Russian oil, gas, coal and nuclear fuel with immediate effect – although this was largely symbolic as ratification would require unanimity from all member states – while the Baltic states took the plunge and announced a cessation of pipeline imports from Russia. Control of Gazprom Germania – a subsidiary of the Russian producer that owns or co-owns more than 11bcm of gas storage capacity in Germany, the Netherlands, Austria and Serbia – was handed over to the German energy regulator, improving prospects for EU storage ahead of next winter.

On the short-term market a cold snap hit the UK through most of the fortnight – while wind output was mostly on the low side – pushing gas demand around 74mcm above the seasonal average.

For more information see our full market update via the link below.

Outlook:

- Summer gas demand is expected to be around 6.5% higher than last year – according to a forecast from TSO National Grid – due to expectations of higher exports to help fill EU storage sites.

- Norwegian summer maintenance is set to step up from April 20th with 40-60mcm of daily capacity unavailable from that date to the end of the month. Restrictions are set to ease slightly in May with 9-25mcm offline. Curtailments in Norway tend to have a greater impact on supply to the UK than elsewhere in Europe due to buyers in the country holding few long-term supply contracts with Norwegian producer Equinor.

- A new study into the safety of fracking was ordered by the UK government, potentially paving the way for the removal of a moratorium on the practice that was imposed in 2019 following opposition from climate groups and concerns over earth tremors associated with the extraction process. The British Geological Survey is expected to produce a report within three months. Shortly after energy company INEOS wrote to the government with a request for it to be allowed to build test site to prove the extraction process can be performed safely.

- The energy security strategy released by the government in early April included a new licensing round for oil and gas field development on the UK continental shelf that is set to take place in the autumn – the first of its kind since 2020 – with a renewed commitment to domestic production following the Russian invasion of Ukraine. Given the current price environment for both oil and gas there is likely to be strong interest in the round.

Read Eneco’s full market update here

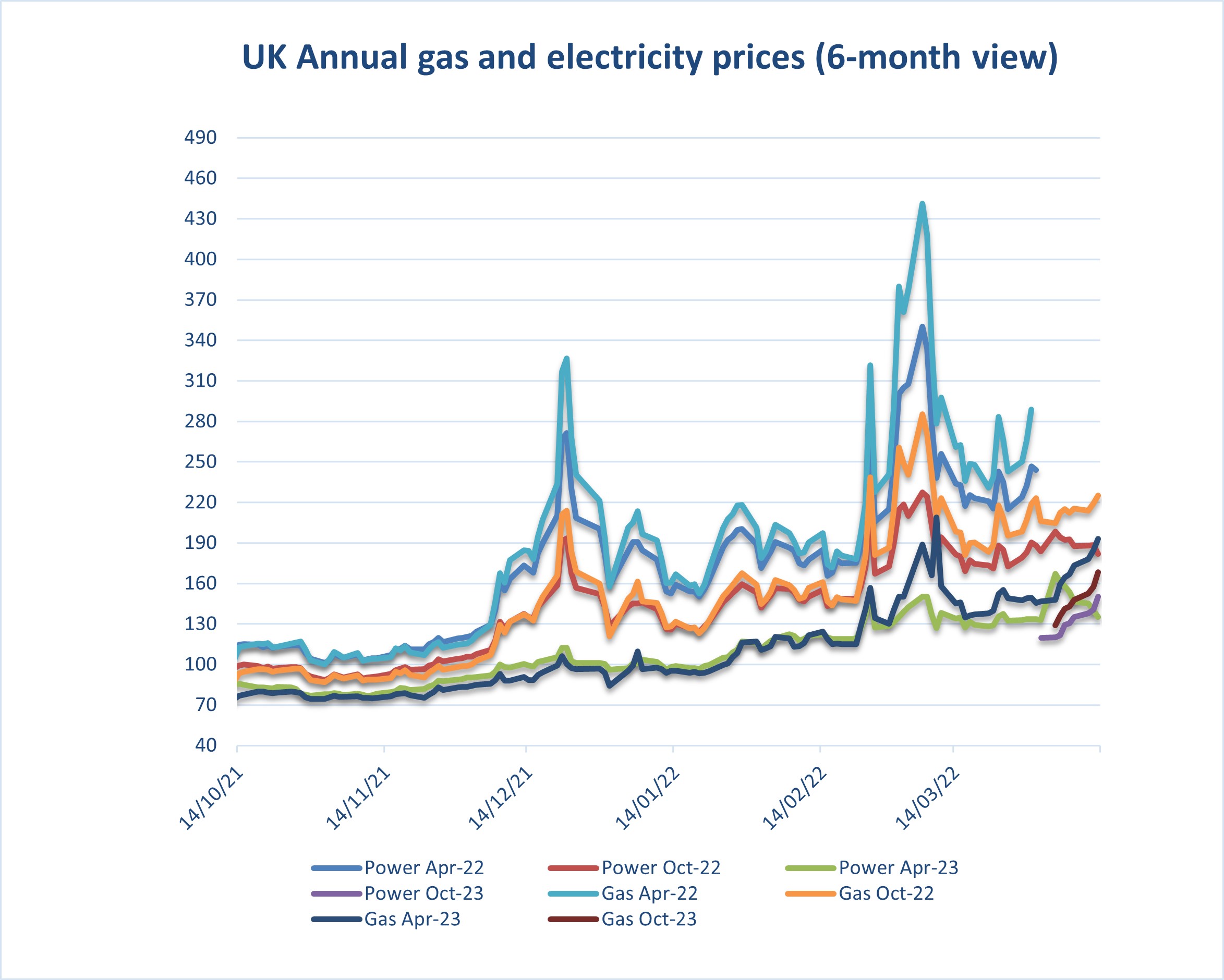

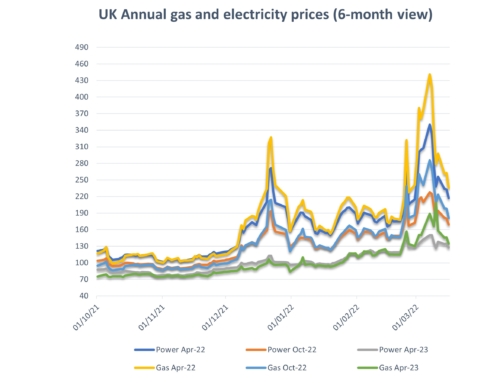

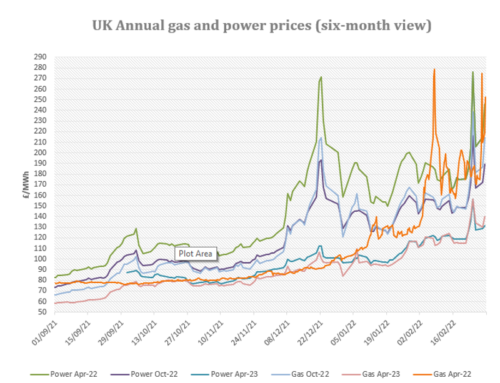

Rolling 3-Year Gas and electricity prices to Mid-April 2022

NET ZERO 2050

As businesses work towards Net Zero, Eneco is looking at ways we can add value to the service we provide and support your journey. We are in talks with potential partner companies who specialise in usage analysis and Net Zero solutions. Look out for further updates on this.

Non-energy costs:

On the electricity side organisations will start seeing increases in pass through costs from both government and industry infrastructure providers due to pandemic-related demand destruction. Levies normally collected via unit rates have fallen short of expectations and have fed through to further increases in ROs, FiTs, EII and other transportation, distribution and renewable investment charges. In addition to this the Targeted Charging Review (TCR) is comes into effect from April 2022. Projections are available on our website via the links below.

Targeted Charging Review (TCR) electricity –

TCR is a change to both Distribution Use of System (DUoS) and Transmission Network Use of System (TNUoS) charges you will find within a supply contract.

-

- DUoS: changes coming into effect from April

-

-

- Paid to the associated distributor (DNO), the cost covers installation and maintenance of local distribution networks.

- Is expected to form part of the standing charge unless billed as an individual charge.

-

-

- TNUoS: changes in effect from 01/04/2023

-

-

- Paid to National Grid, the cost recovers the cost of installing and maintaining transmissions systems.

- At present, the charge is based on a meter’s share of demand on the network during 3 peak periods, known as Triads. These 3 Triad periods occur between 1st Nov to 28th Feb each year. It’s assessed during this time as demand on the grid is at its highest.

-

Historically these charges were based on volume used. It is felt that switching these to a fixed charge based on capacity and location will be a fairer and more consistent way to levy charges.

Is your organisation covered by the new Streamlined Energy and Carbon Reporting (SECR) scheme from the Environment Agency?

Designed to replace in part the Carbon Reduction Commitment (CRC) which ended in 2019 and to follow on from the energy savings recommendations generated by ESOS compliance. Note, SECR will cover a wider scope of organisations than CRC and ESOS do. SECR requires all large enterprises to disclose within their annual financial filing obligations to Companies House, their greenhouse gas emissions, energy usage (from gas, electricity and transportation as a minimum), energy efficiency actions and progress against at least one intensity ratio.

If your organisation qualifies, participation in this scheme is mandatory. Eneco Consulting are happy to provide assistance with your regulatory obligations. Full details are available on our website on the link below.

Are you eligible for an EII rebate?

Under current rules, if you qualify at an industry sector level and your business passes the 20% electricity intensity test you may qualify for exemption to CFD and RO charges. Please see the attached Government RO/CFD guidance document and update and give Abby a call on the main number to discuss this further.

A copy of our environmental charges and Climate Change Levy rates from 2012 to date: Industry and Environmental Pass Through Charges including CCL p/kWh Updated 31082021

A copy of RO/CFD guidance document: RO_CFD_Guidance_Revised_July_2018

SECR: SECR EA Guidelines

TCR Charges (Targeted Charging Review this will be revised in November 2021 when Ofgem releases its review): TCR Charges (Targeted Charging Review) TNUOS bandings and Current Ofgem Costs now for 2023 onwards