Eneco market reports early March 2022

Russian conflict with Ukraine

On Tuesday, Biden announced a cease of all imports of oil and coal from Russia following discussions with close allies and partners in Europe, recognising that it would be less feasible for some to apply the same sanctions. The UK has announced it will also cease imports of Russian oil and oil based products by the end of 2022. There are no direct imports of gas from Russia, and it is estimated that around 4% of UK import will have originated from Russia.

As Russian energy forms some 40% of European supply it is unlikely Europe will apply similar sanctions at this stage, although concerns were expressed that Putin might use this to retaliate against sanctions being applied. That being said, this is a key revenue for Russia and it is felt supply will be safe for the time being.

Concerns have been raised regarding supply from Gazprom, the Russian state-owned supplier, should further sanctions be applied. For the time being the general advice is, that no matter what the political/humanitarian sentiment; a contract is a contract and legally binding with all the consequences of breaching it. It is worth remembering that business customers do not have the same protections as domestic, and a supplier is not obligated to supply them. If Gazprom are unable to trade for financial reasons or UK government intervention it will be a Force Majeure situation that will alter the playing field but basically until that happens you are essentially bound to the contract. We have been made aware that customers have been approached by some third parties claiming they need to sign a new contract to replace their Gazprom supply. At this stage this is not correct. We are monitoring the news and seeking advice and will update those who may be affected as and when we have more information.

Targeted Charge Review (TCR)

On the 1st April 2022, the way in which Network Operators recover their costs from suppliers will change, as part of Ofgem’s Targeted Charging Review (TCR).

As a result, the distribution of these network charges will partly shift away from Unit Rates and into Standing Charges. Those on flexible contracts will see these changes from their April invoices onwards. Those on fixed contracts are likely to see these increases reflected in renewal prices.

Energy costs:

UK and European market volatility continues amidst the ongoing conflict between Russia and Ukraine, with markets seeing significant spikes, dropping and spiking again reaching highs in excess of 500£/MWh on month ahead. For the moment, the energy sector has been exempt from sanctions against Russia, although some restrictions have been advised. The market remains uncertain with many suppliers withdrawing price books temporarily, affecting some upcoming renewals. There is concern at offering quotes which may be based on a short-term spike and suppliers are concerned pricing under these circumstances could be unfair.

Wind generation throughout February delivered some 36% of supply as opposed to around 24% in January. Nuclear output from EDF was downgraded for 2023, with unplanned maintenance outages having some impact. Overall, however, the UK was a net importer from France with some 1GW delivered each day in the latter part of February against 259MW in the first half.

Temperatures have continued to be mild and overall have been seen to be above seasonal norms.

Outlook:

- On 6 March maintenance will take some 660 MW of capacity offline at the Heysham nuclear plant until 9 April. A 506 MW restriction at another reactor at Heysham is expected between 9 March and 17 July.

- During March another 908 GW of French nuclear capacity will come offline for maintenance lasting at least a month, meaning UK supply is likely to be called upon more frequently.

- The T-1 Capacity Market (CM) auction cleared at a record price of £45/kW/year – the highest ever recorded. CM participants are paid to ensure power assets are available at times of system stress to ensure security of supply. Outages at several nuclear plants and the removal of the Severn Power and Sutton Bridge combined cycle gas turbines from the process reportedly lifted the clearing price. At least 13 battery storage companies had assets cleared, up from just two at the previous auction.

- From the 15th of March the full 1.4 GW capacity will become available on the North Sea Link power interconnector between the UK and Norway, when the 350 MW currently offline is restored. Commercial operations on the North Sea Link started on the 1st of October last year and since then the UK has imported 654 MW on average each day. In the last week of February power flows on this link were consistently close to the current maximum capacity of just over 1 GW.

Gas costs:

As with electricity markets, gas prices skyrocketed in early March with prices exceeding record levels of 700p/th on some days. Currently gas sits between 400 and 500p/th and continues to remain high whilst traders navigate the impacts of any sanctions being applied along with the ongoing conflict around Ukraine.

Since the invasion launched physical Russian gas flows via Ukraine have increased, with volumes delivered through this route and into Slovakia at around 80mcm/day since the 25th – up from an average of 41mcm/day this year prior to that date, with some analysts suggesting the rise has been driven by buyers that hold long-term supply contracts with Russian producer Gazprom increasing off-take nominations through those contracts, rather than Russia itself actively pushing more gas into Europe in an attempt to mollify Continental anger and anxiety.

LNG deliveries remained high and accounted for just over a fifth of the UK total whilst pipeline flows ticked higher. Day ahead prices for gas sat at around 188p/th before the price gently rose and then ballooned over the last few days.

This morning, Brent crude, an international benchmark, dropped more than 17% at one point after a statement made by the United Arab Emirates which stated that they favoured production increases and will be encouraging Opec to consider higher production levels.

Outlook:

- German energy companies are reportedly shunning new deals with Gazprom Marketing & Trading – the trading arm of the Russian producer that is based in London – to avoid potential sanctions. Crude oil buyers are also said to be avoiding purchases of Russian barrels, with the supply crisis leading the International Energy Agency (IEA) to release 60m barrels from its emergency reserves.

- UK TSO National Grid is seeking clarity on whether to bar Russian LNG cargoes from the Isle of Grain terminal following a government order that all ports block Russia-linked ships from docking.

- The UK’s National Policy Statement (NPS) for new energy infrastructure does not go far enough in supporting net zero ambitions, according to a policy review by the House of Commons business, energy and industrial strategy select committee. The review called for onshore wind to be included in the updated document after its removal in 2016, as well as new carbon capture and hydrogen projects.

- Wind output is expected to be robust in the coming weeks, with an Elexon forecast pointing to generation averaging at least 10.5 GW between the 8th and 16th of March, compared with an average so far this winter of 8.4 GW, which will reduce the need for gas-fired production.

- Temperatures through most of Europe are forecast above average throughout March – according to the EU Copernicus service – paving the way for early storage injections, if prices come down.

Factors supporting Increases:

Gas storage – European storage volumes remain low, and current market levels do not incentivise to increase levels

French Nuclear Power – EDF has reduced its output forecast for 2023 and indicated further outages for maintenance likely resulting in a need to draw on UK supply

Nord Stream 2 – The current outlook suggests this will now not go ahead

Russia/Ukraine Tensions – Russia’s attacks on Ukraine continue despite ceasefire agreements driving a need to increase sanctions, with the US ceasing all import from Russia and the UK indicating a cease of all import of oil and oil based products by end 2022.

Factors supporting decreases:

LNG –LNG deliveries remained consistent contributing to some 30% of supply.

Supply outages – A reduced level of unplanned outages at this time although EDF has downgraded its nuclear output for 2023

Weather/Wind – Mild temperatures and moderate wind generation are expected this week.

Oil markets – Oil has decreased to around $112/barrel following a statement from the UAE that they have encouraged Opec to increase production.

Non-energy costs:

On the electricity side organisations will start seeing increases in pass through costs from both government and industry infrastructure providers due to pandemic-related demand destruction. Levies normally collected via unit rates have fallen short of expectations and have fed through to further increases in ROs, FiTs, EII and other transportation, distribution and renewable investment charges. In addition to this the Targeted Charging Review (TCR) is comes into effect from April 2022. Projections are available on our website via the links below.

Targeted Charging Review (TCR) electricity –

TCR is a change to both Distribution Use of System (DUoS) and Transmission Network Use of System (TNUoS) charges you will find within a supply contract.

-

- DUoS: changes coming into effect from April

-

-

- Paid to the associated distributor (DNO), the cost covers installation and maintenance of local distribution networks.

- Is expected to form part of the standing charge unless billed as an individual charge.

-

-

- TNUoS: changes in effect from 01/04/2023

-

-

- Paid to National Grid, the cost recovers the cost of installing and maintaining transmissions systems.

- At present, the charge is based on a meter’s share of demand on the network during 3 peak periods, known as Triads. These 3 Triad periods occur between 1st Nov to 28th Feb each year. It’s assessed during this time as demand on the grid is at its highest.

-

Historically these charges were based on volume used. It is felt that switching these to a fixed charge based on capacity and location will be a fairer and more consistent way to levy charges.

Is your organisation covered by the new Streamlined Energy and Carbon Reporting (SECR) scheme from the Environment Agency?

Designed to replace in part the Carbon Reduction Commitment (CRC) which ended in 2019 and to follow on from the energy savings recommendations generated by ESOS compliance. Note, SECR will cover a wider scope of organisations than CRC and ESOS do. SECR requires all large enterprises to disclose within their annual financial filing obligations to Companies House, their greenhouse gas emissions, energy usage (from gas, electricity and transportation as a minimum), energy efficiency actions and progress against at least one intensity ratio.

If your organisation qualifies, participation in this scheme is mandatory. Eneco Consulting are happy to provide assistance with your regulatory obligations. Full details are available on our website on the link below.

Are you eligible for an EII rebate?

Under current rules, if you qualify at an industry sector level and your business passes the 20% electricity intensity test you may qualify for exemption to CFD and RO charges. Please see the attached Government RO/CFD guidance document and update and give Abby a call on the main number to discuss this further.

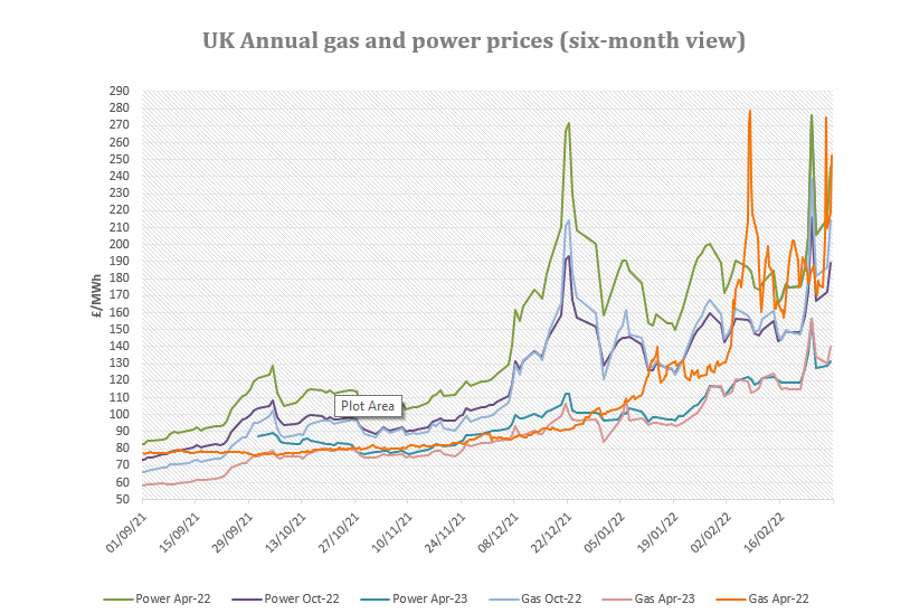

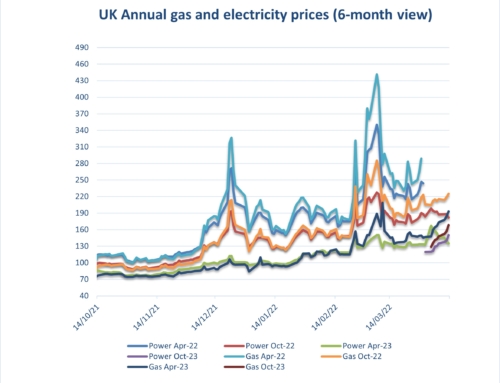

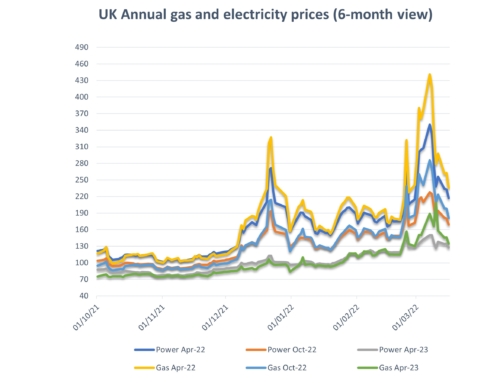

Rolling 6-Year Gas and electricity prices to early March 2022

A copy of our environmental charges and Climate Change Levy rates from 2012 to date: Industry and Environmental Pass Through Charges including CCL p/kWh Updated 31082021

A copy of RO/CFD guidance document: RO_CFD_Guidance_Revised_July_2018

SECR: SECR EA Guidelines

TCR Charges (Targeted Charging Review this will be revised in November 2021 when Ofgem releases its review): TCR Charges (Targeted Charging Review) TNUOS bandings and Current Ofgem Costs now for 2023 onwards