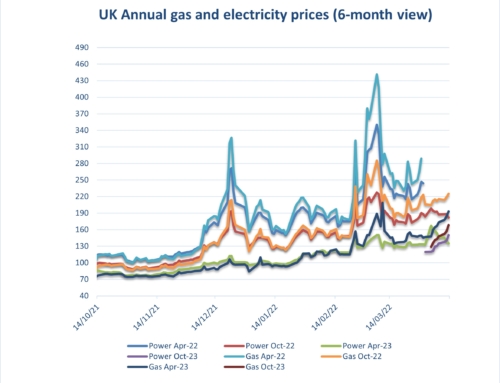

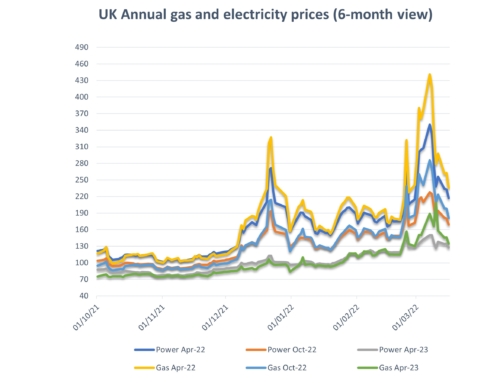

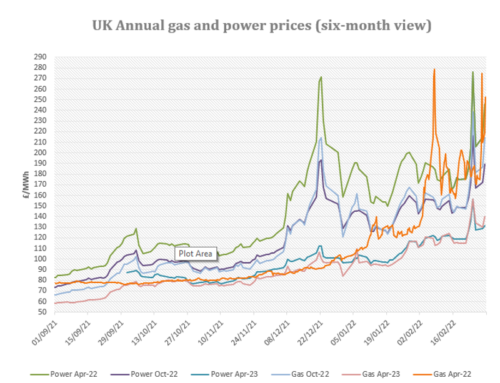

Energy costs: Annuals prices have surged by up to 14% due to the Christmas freeze, last minute Brexit deal and booked LNG deliveries diverted towards higher market prices in the Far East. Although markets fell back initially in response to this weeks renewed UK lockdown, a tight supply outlook and Saudi Arabia/OPEC’s agreement to cut oil production further have forced prices back up. A milder and windier weather outlook and continued lockdowns across Europe may depress prices again as we approach the second half of January.

Upside:

Supply outages – Supplies were impacted by unplanned outages during late December causing significant spikes in short-term prices. The markets remain vulnerable to further outages while freezing temperatures continue.

Oil markets have been boosted by agreement between Saudi Arabia and OPEC to further oil production cuts.

Carbon costs rose to record highs as the UK left the European trading scheme and due to expectations of increased economic activity.

LNG – Booked LNG deliveries are rerouting to the Far East attracted by higher prices.

Gas storage – European gas storage fell to 72% fullness, compared to 84% last year – as demand soared due to the cold snap.

Downside:

Weather – The Winter-Freeze is forecasted to be replaced by milder and windier weather as we approach mid-January.

Lockdown – Gas and power demand are likely to decline as the new UK lockdown progresses.

Could go either way:

Sterling – Has been particularly volatile in recent weeks. Having been boosted by the last minute agreement of Brexit terms, Sterling took a hit when the UK re-entered lockdown. This is feeding further energy price volatility.

Non-energy costs:

On the electricity side organisations will see further increases in pass through costs from both government and industry infrastructure providers from 2022 onwards due to pandemic-related demand destruction. Levies normally collected via unit rates have fallen short of expectations and have fed through to further increases in ROs, FiTs, EII and other transportation, distribution and renewable investment charges. Targeted Charging Review will now take affect from April 1st 2022, one year later than expected, but are now being built into longer term contracts. Revised projections are available on our website via the links below.

Is your organisation covered by the new Streamlined Energy and Carbon Reporting (SECR) scheme from the Environment Agency?

Designed to replace in part the Carbon Reduction Commitment (CRC) which ended in 2019 and to follow on from the energy savings recommendations generated by ESOS compliance. Note, SECR will cover a wider scope of organisations than CRC and ESOS do. SECR requires all large enterprises to disclose within their annual financial filing obligations to Companies House, their greenhouse gas emissions, energy usage (from gas, electricity and transportation as a minimum), energy efficiency actions and progress against at least one intensity ratio.

If your organisation qualifies, participation in this scheme is mandatory. Eneco Consulting are happy to provide assistance with your regulatory obligations. Full details are available on our website on the link below.

Are you eligible for an EII rebate?

Under current rules, if you qualify at an industry sector level and your business passes the 20% electricity intensity test you may qualify for exemption to CFD and RO charges. Please see the attached Government RO/CFD guidance document and update and give Abby a call on the main number to discuss this further.

A copy of our detailed market report is available: Eneco Market Information early Jan 2021

Gas and electricity prices from 2009 to date are available here: Eneco Gas and Electricity Pricing Trends early Jan 2021

A copy of our environmental charges and Climate Change Levy rates from 2012 to date: Environmental Pass Through Charges and CCL with Definitions ppkWh 02.12.20

A copy of RO/CFD guidance document: RO_CFD_Guidance_Revised_July_2018

SECR: SECR EA Guidelines

TCR Charges (Targeted Charging Review): TCR Charges (Targeted Charging Review)