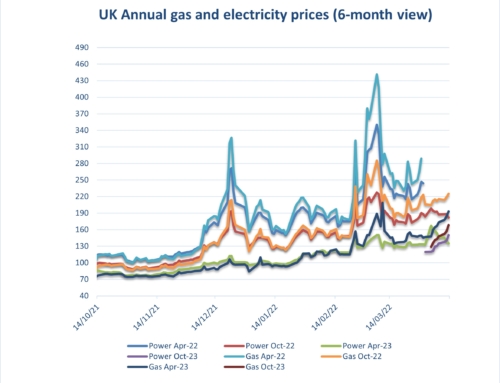

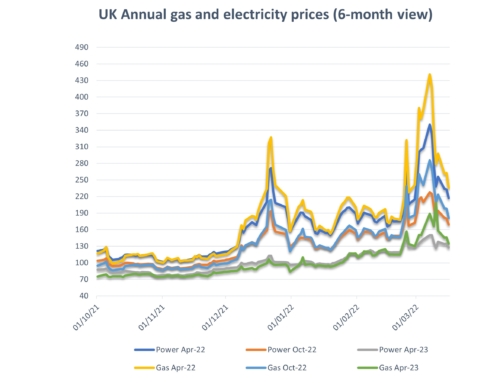

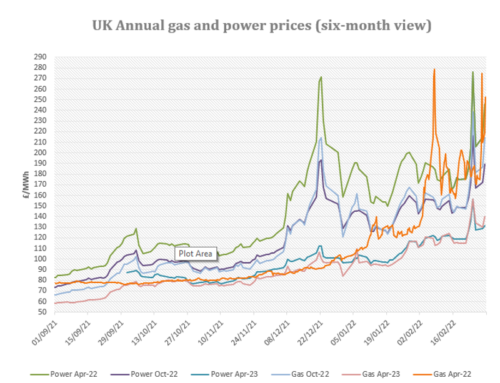

Energy costs: Gas and electricity annuals increased by over 12% in the second week of March following the agreement of the US stimulus package, oil peaked at $70/barrel with OPEC voting to extend production cuts, coal tipped $71/tonne, Asian LNG costs rebounded, and European carbon costs increased 15% to new record highs. Tightened supplies also fuelled the price surge – the BritNed interconnector was taken offline for unscheduled maintenance, as were multiple UK power stations for a variety of issues and Russian gas pipelines suffered intermittent issues. Prices showed signs of softening late into last week as oil crashed back to $63/barrel due to continued demand uncertainty not helped by Europe’s stalling vaccine roll out. Weather is likely to be warmer, wetter and windier over the coming fortnight which will at least boost wind generation. However, markets are likely to remain turbulent moving forward.

Upside:

Supply outages – The system has been plagued with outages across the UK and Europe which has produced significant volatility on short term markets. BritNed interconnector will be offline until at least May due to a cabling fault. Norwegian gas production will be limited by planned maintenance into late April. French Nuclear staff have announced strike action from late March to early April (Easter).

Oil markets – OPEC have decided to extend production cuts for the moment due to the widespread held belief that oil demand will not fully recover until 2025. The recent extreme volatility is likely to continue while European vaccine rollout remains patchy and demand outlook uncertain.

Coal – Prices have dropped back to $68/tonne as winter demand has waned and the dollar strengthened.

Gas storage – European storage is at 32%, compared to 56% this time last year.

Downside:

LNG – LNG prices have increased in Asia, but deliveries to Europe have so far been unaffected.

Carbon costs – EUA’s peaked at EURO 44/TCO2 due to continued speculator activity which the EU is attempting to curb. UK emissions will start trading in mid-May.

Weather – Temperatures are expected to be warmer, but wet and windy over the coming fortnight.

Lockdown – Gas and power demand remain dampened by the continuing UK lockdown. However, this will change as the lockdown restrictions begin to be lifted from April 12th.

Could go either way:

Sterling – has continued to strengthen against both the Dollar and Euro since December 2020 shielding the UK energy markets for some of the impact of oil, coal and carbon price increases. The continued rollout of the UK’s vaccination programme will influence its future direction.

Non-energy costs:

On the electricity side organisations will see further increases in pass through costs from both government and industry infrastructure providers from 2022 onwards due to pandemic-related demand destruction. Levies normally collected via unit rates have fallen short of expectations and have fed through to further increases in ROs, FiTs, EII and other transportation, distribution and renewable investment charges. Targeted Charging Review will now take affect from April 1st 2022, one year later than expected, but are now being built into longer term contracts. Revised projections are available on our website via the links below.

Is your organisation covered by the new Streamlined Energy and Carbon Reporting (SECR) scheme from the Environment Agency?

Designed to replace in part the Carbon Reduction Commitment (CRC) which ended in 2019 and to follow on from the energy savings recommendations generated by ESOS compliance. Note, SECR will cover a wider scope of organisations than CRC and ESOS do. SECR requires all large enterprises to disclose within their annual financial filing obligations to Companies House, their greenhouse gas emissions, energy usage (from gas, electricity and transportation as a minimum), energy efficiency actions and progress against at least one intensity ratio.

If your organisation qualifies, participation in this scheme is mandatory. Eneco Consulting are happy to provide assistance with your regulatory obligations. Full details are available on our website on the link below.

Are you eligible for an EII rebate?

Under current rules, if you qualify at an industry sector level and your business passes the 20% electricity intensity test you may qualify for exemption to CFD and RO charges. Please see the attached Government RO/CFD guidance document and update and give Abby a call on the main number to discuss this further.

A copy of our detailed market report is available: Eneco Market Information mid Mar 2021

Gas and electricity prices from 2009 to date are available here: Eneco Gas and Electricity Pricing Trends mid Mar 2021

A copy of our environmental charges and Climate Change Levy rates from 2012 to date: Environmental Pass Through Charges and CCL with Definitions ppkWh 02.12.20

A copy of RO/CFD guidance document: RO_CFD_Guidance_Revised_July_2018

SECR: SECR EA Guidelines

TCR Charges (Targeted Charging Review): TCR Charges (Targeted Charging Review)