Eneco market reports early September 2021

Energy costs:

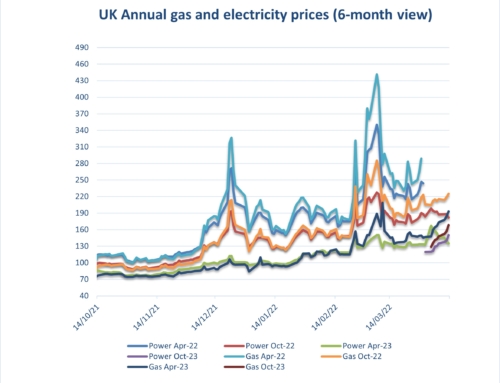

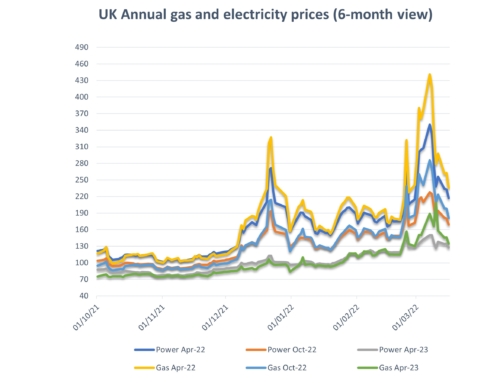

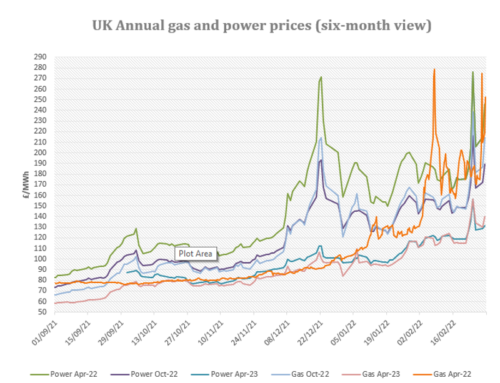

Markets crashed by over 10% on August 19th on reports that Russia’s Nord Stream 2 pipeline would be completed early in September and bolster European gas storage. Thereafter prices surged up a further 30% on confirmation that Russia would not be increasing its gas exports in Winter ’21 as hoped. These renewed supply concerns and rising prices across the wider energy complex have seen ‘21/’22 annual markets for both gas and electricity reach triple digits for the first time ever.

Norwegian and North Sea gas flows slumped following further unplanned maintenance issues. Low wind generation and unplanned Nuclear outages piled pressure on already limited gas supplies for power generation. Stronger markets in Asia continued to attract LNG supplies away from Europe adding to supply problems.

Coal soared to $118/tonne and carbon allowances reached a record high of 62 EURO/TCO2. Oil markets, although affected by Hurricane Ida disrupting US oil and gas production, were kept in check by OPEC’s planned production increases.

There seems very little likelihood that this picture will change over the next fortnight, particularly given wind generation is likely to remain low. There are even reports that some energy intensive industries are planning to slow down/switch off production over winter until the price outlook improves.

Factors supporting Increases:

Supply outages –Norwegian and North Sea unplanned production outages continue with flows significantly reduced.

Gas storage – European storage is at 67%, compared to 91% this time last year. Concerns over storage levels in the light of a potentially cold start to winter continue to drive current market increases.

Carbon – EUETS emissions reached EURO 62/TC02 due to the continued use of coal for electricity generation.

Coal – Prices have topped $118/tonne as supply issues persist around the globe and demand for coal fired generation increases particularly in Asia.

LNG –Asian LNG prices have seen a threefold increase in the last 8-months fuelled by high demand and deliveries to Europe limited. The UK has only 1 delivery rostered for the month of September.

Weather – Higher temperatures are expected across most of the UK with low wind output.

Factors supporting decreases:

Norway-UK interconnector – test flows were sent across the interconnector in August and this is expected to be fully commissioned shortly.

Oil markets – Oil is currently trading around $72/barrel, kept in check by OPEC’s planned production increases.

Could go either way:

Sterling – has weakened slightly against the dollar and euro. However, this should be monitored as this can amplify increases on the wider energy markets onto UK gas and electricity markets.

Wind capacity – 2021 has seen a threefold increase in new wind capacity prompting hopes of a bearish Autumn/Winter. However, output over the summer has been negligible.

Non-energy costs:

On the electricity side organisations will see further increases in pass through costs from both government and industry infrastructure providers from 2022 onwards due to pandemic-related demand destruction. Levies normally collected via unit rates have fallen short of expectations and have fed through to further increases in ROs, FiTs, EII and other transportation, distribution and renewable investment charges. In addition to this the Targeted Charging Review (TCR) is coming into effect from April 2022 and is being priced into renewal contracts now. Projections are available on our website via the links below.

What is the Targeted Charging Review (TCR) electricity –

TCR is a change to both Distribution Use of System (DUoS) and Transmission Network Use of System (TNUoS) charges you will find within a supply contract.

DUoS: changes in effect from 01/04/2022 (delayed from 2021)

- Paid to the associated distributor (DNO), the cost covers installation and maintenance of local distribution networks.

- At present, a DUoS charge is based on the volume of electricity consumed at site, which has passed through the distribution network.

TNUoS: changes in effect from 01/04/2023 (delayed from 2022)

- Paid to National Grid, the cost recovers the cost of installing and maintaining transmissions systems.

- At present, the charge is based on a meter’s share of demand on the network during 3 peak periods, known as Triads. These 3 Triad periods occur between 1st Nov to 28th Feb each year. It’s assessed during this time as demand on the grid is at its highest.

Why the change? A lot of businesses have Triad avoidance techniques in place. During November to February, the 3 largest consuming days will affect a TNUoS charge for a whole year, therefore it pays to be savvy in cutting down consumption on days which would otherwise have been large consuming. Ofgem want to eradicate an unfair grid, therefore both DUoS and TNUoS charges will be veering away from a consumption-based charge to a daily-based charge, determined by voltage type (where you connect to the network), measurement class (Half-Hourly/Non-Half-Hourly), and maximum agreed capacity.

It’s a complex change and difficult to assess the impact on individual meters as suppliers are allocating charges differently. although many are wrapping TCR into increased standing charges. However, to summarise, meters with high capacity but lower usage will be worst affected. For example, a sports stadium will have a high agreed capacity to account for large peaks on event/match days, yet for the most part will have a relatively small usage compared to this capacity. If you want to discuss this further, please call into the office to speak with Abby.

Is your organisation covered by the new Streamlined Energy and Carbon Reporting (SECR) scheme from the Environment Agency?

Designed to replace in part the Carbon Reduction Commitment (CRC) which ended in 2019 and to follow on from the energy savings recommendations generated by ESOS compliance. Note, SECR will cover a wider scope of organisations than CRC and ESOS do. SECR requires all large enterprises to disclose within their annual financial filing obligations to Companies House, their greenhouse gas emissions, energy usage (from gas, electricity and transportation as a minimum), energy efficiency actions and progress against at least one intensity ratio.

If your organisation qualifies, participation in this scheme is mandatory. Eneco Consulting are happy to provide assistance with your regulatory obligations. Full details are available on our website on the link below.

Are you eligible for an EII rebate?

Under current rules, if you qualify at an industry sector level and your business passes the 20% electricity intensity test you may qualify for exemption to CFD and RO charges. Please see the attached Government RO/CFD guidance document and update and give Abby a call on the main number to discuss this further.

Eneco market information early September 2021

Gas and electricity prices from 2009 to date

A copy of our environmental charges and Climate Change Levy rates from 2012 to date: Industry and Environmental Pass Through Charges including CCL p/kWh Updated 31082021

A copy of RO/CFD guidance document: RO_CFD_Guidance_Revised_July_2018

SECR: SECR EA Guidelines

TCR Charges (Targeted Charging Review this will be revised in November 2021 when Ofgem releases its review): TCR Charges (Targeted Charging Review) TNUOS bandings and Current Ofgem Costs now for 2023 onwards