Eneco market reports mid December 2021

Energy costs:

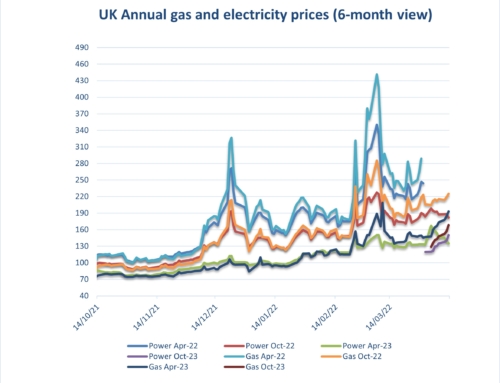

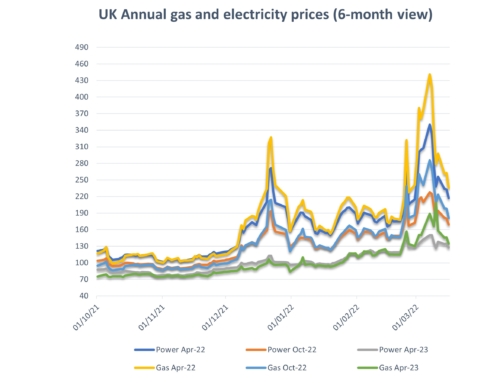

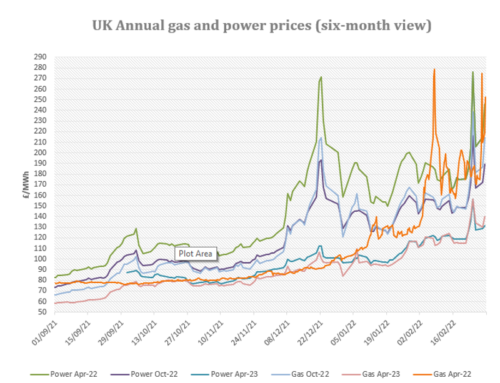

Month-ahead and quarter-ahead UK power prices have soared to all-time highs over the last few days, rocketing to £490/MWh and £385/MWh respectively yesterday, up 36% and 18% on the day – after the sudden shutdown of two reactors at the Chooz French nuclear plant for preventative safety checks panicked European power and gas markets that were already hypersensitised to any supply issues. January French power leapt by more – ending Thursday at EUR 660/MWh – up 70% on the day.

Outlook:

- A ramp-up in operational capacity in the NSL Norway-UK interconnector, from 700 MW to at least 1050 MW, has been delayed by yet another month to mid-February while its operators continue to resolve technical issues with the cable. Further delays will limit the UK’s power import potential.

- The UK ETS Authority has decided to “not redistribute or release additional supply…at this time” to rein in UKA carbon allowance prices, despite the CCM (Cost Containment Mechanism) threshold being triggered at the start of December.

Global coal-fired generation is expected to reach a record 10,350 TWh this year, up 9% on last year, due to the global gas supply squeeze, according to the IEA (International Energy Agency), which says output may increase further over the next three years.

- After the last price spike in late September/early October, the market witnessed a sharp and sustained downwards correction. Could the same thing now happen after this latest spike?

UK gas annual prices have hit consecutive record levels over the last week, peaking yesterday as the front Annual (April ’22 Annual) reached 195 p/th (well above the 166 p/th peak of the previous spike in late September). Record levels have been seen on other periods too, with end-of-day Month-ahead and Quarter-ahead prices hitting 360 p/th and 345 p/th respectively. All periods out to March are now valued well above 300 p/th.

Outlook:

- Any further unexpected supply issues, even minor ones, may trigger more bullishness, while an extended cold snap in the UK or Europe could send supply and storage fears into overdrive.

- Extremely cold weather is forecast for western Russia until mid-January, with temperatures in Moscow expected to drop beneath -17 degrees C next week. While this will boost demand there, this should be easily met by the significant volumes of gas in Russia’s domestic storage sites, which were nearly fully replenished ahead of the winter.

- Strike action by 300 workers at fields and other North Sea gas and oil infrastructure owned by TotalEnergies, which was to last between December 6th until late February, disrupting production and operations, has been called off after a week, after the workers were offered an improved pay deal.

Factors supporting Increases:

Gas storage – European storage still well belo0w capacity with concerns over storage levels in the light of a potentially cold start to winter continue to drive current market increases.

Carbon – EUETS emissions reached EURO 68/TC02 due to continued heavy reliance coal and gas for power generation.

Coal – Currently priced at $128/tonne as supply issues persist around the globe and demand for coal fired generation increases particularly in Asia.

French Nuclear Power – The closure of 2 major nuclear power stations has had significant impact

Weather/Wind – Cold temperatures and low wind generation are expected from the weekend, which may create further market volatility.

Nord Stream 2 – Ongoing delays with Germany holding licencing until compliance with EU legislation.

Factors supporting decreases:

LNG –LNG deliveries are now unloading regularly into the UK and Europe. However, rather bizarrely tracking of many shipments currently at sea has been suspended due to concerns over Chinese hacking.

Oil markets – Oil has fallen back to $75/barrel, with oversupply concerns from OPEC due to increasing covid-19 cases and potential further lockdowns.

Supply outages – Further Norwegian outages contributed to this week’s market spike although they appear to be resolved for the moment. We await Gazprom’s increase gas flows as per Putin’s commitment.

Could go either way:

Sterling – has weakened slightly against the Dollar but remains largely stable against the Euro. However, this should be monitored as this can amplify increases on the wider energy markets onto UK gas and electricity markets.

Non-energy costs:

On the electricity side organisations will see further increases in pass through costs from both government and industry infrastructure providers from 2022 onwards due to pandemic-related demand destruction. Levies normally collected via unit rates have fallen short of expectations and have fed through to further increases in ROs, FiTs, EII and other transportation, distribution and renewable investment charges. In addition to this the Targeted Charging Review (TCR) is coming into effect from April 2022 and is being priced into renewal contracts now. Projections are available on our website via the links below.

What is the Targeted Charging Review (TCR) electricity –

TCR is a change to both Distribution Use of System (DUoS) and Transmission Network Use of System (TNUoS) charges you will find within a supply contract.

DUoS: changes in effect from 01/04/2022 (delayed from 2021)

- Paid to the associated distributor (DNO), the cost covers installation and maintenance of local distribution networks.

- At present, a DUoS charge is based on the volume of electricity consumed at site, which has passed through the distribution network.

TNUoS: changes in effect from 01/04/2023 (delayed from 2022)

- Paid to National Grid, the cost recovers the cost of installing and maintaining transmissions systems.

- At present, the charge is based on a meter’s share of demand on the network during 3 peak periods, known as Triads. These 3 Triad periods occur between 1st Nov to 28th Feb each year. It’s assessed during this time as demand on the grid is at its highest.

Why the change? A lot of businesses have Triad avoidance techniques in place. During November to February, the 3 largest consuming days will affect a TNUoS charge for a whole year, therefore it pays to be savvy in cutting down consumption on days which would otherwise have been large consuming. Ofgem want to eradicate an unfair grid, therefore both DUoS and TNUoS charges will be veering away from a consumption-based charge to a daily-based charge, determined by voltage type (where you connect to the network), measurement class (Half-Hourly/Non-Half-Hourly), and maximum agreed capacity.

It’s a complex change and difficult to assess the impact on individual meters as suppliers are allocating charges differently. although many are wrapping TCR into increased standing charges. However, to summarise, meters with high capacity but lower usage will be worst affected. For example, a sports stadium will have a high agreed capacity to account for large peaks on event/match days, yet for the most part will have a relatively small usage compared to this capacity. If you want to discuss this further, please call into the office to speak with Abby.

Is your organisation covered by the new Streamlined Energy and Carbon Reporting (SECR) scheme from the Environment Agency?

Designed to replace in part the Carbon Reduction Commitment (CRC) which ended in 2019 and to follow on from the energy savings recommendations generated by ESOS compliance. Note, SECR will cover a wider scope of organisations than CRC and ESOS do. SECR requires all large enterprises to disclose within their annual financial filing obligations to Companies House, their greenhouse gas emissions, energy usage (from gas, electricity and transportation as a minimum), energy efficiency actions and progress against at least one intensity ratio.

If your organisation qualifies, participation in this scheme is mandatory. Eneco Consulting are happy to provide assistance with your regulatory obligations. Full details are available on our website on the link below.

Are you eligible for an EII rebate?

Under current rules, if you qualify at an industry sector level and your business passes the 20% electricity intensity test you may qualify for exemption to CFD and RO charges. Please see the attached Government RO/CFD guidance document and update and give Abby a call on the main number to discuss this further.

Eneco market information mid December 2021

Gas and electricity prices from 2009 to date

A copy of our environmental charges and Climate Change Levy rates from 2012 to date: Industry and Environmental Pass Through Charges including CCL p/kWh Updated 31082021

A copy of RO/CFD guidance document: RO_CFD_Guidance_Revised_July_2018

SECR: SECR EA Guidelines

TCR Charges (Targeted Charging Review this will be revised in November 2021 when Ofgem releases its review): TCR Charges (Targeted Charging Review) TNUOS bandings and Current Ofgem Costs now for 2023 onwards