Eneco market reports Mid-March 2022

Russian conflict with Ukraine

Peace talks look more positive following Ukraine’s acknowledgement that joining NATO will be unlikely; improving Putin’s receptiveness. It has been suggested a 15-point plan has been drawn up and Ukraine’s President Volodymyr Zelenskyy has said Russia’s demands for ending the war were becoming more realistic. That being said, reports of further attacks over the weekend do not instil confidence.

Customers of Gazprom are still advised to stick with existing contracts. Ofgem are working closely with the government to establish a process should events escalate again and further sanctions come in. At this stage there is no update other than to stick where you are as there are no current plans likely to affect supply.

Targeted Charge Review (TCR)

On the 1st April 2022 Ofgem’s Targeted Charging Review (TCR) comes into effect and customers will see a shift from unit rate to standing charge. Those on flexible contracts will see this change from April and should already have received information from suppliers.

Those on fixed contracts are likely to see these changes reflected in renewal prices.

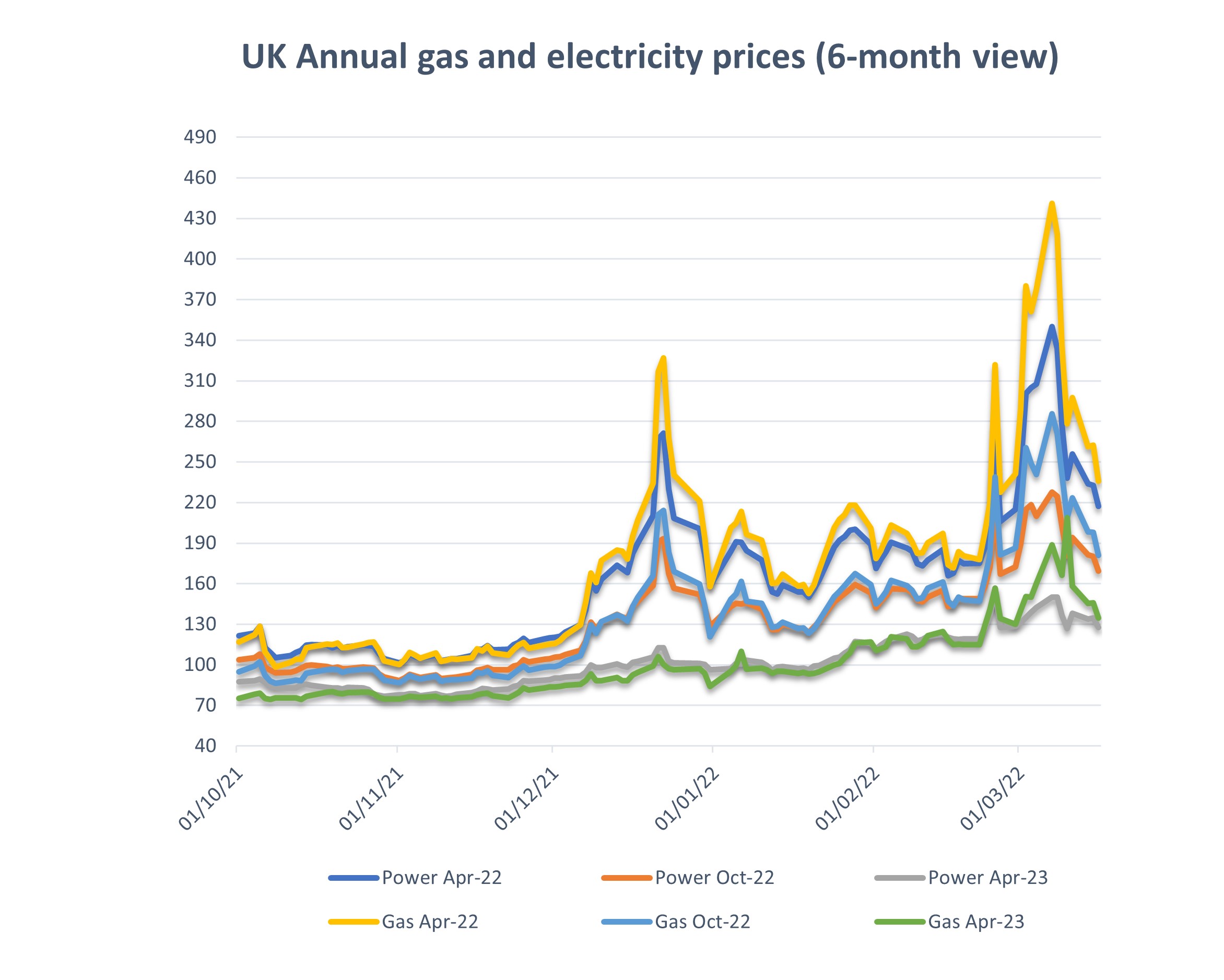

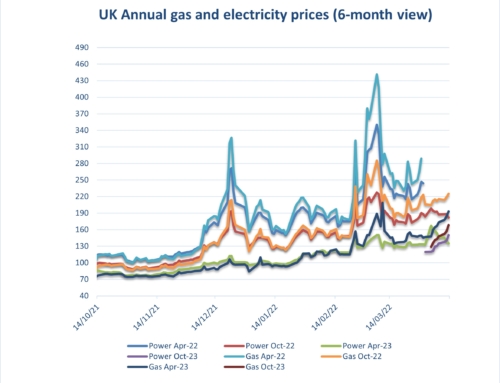

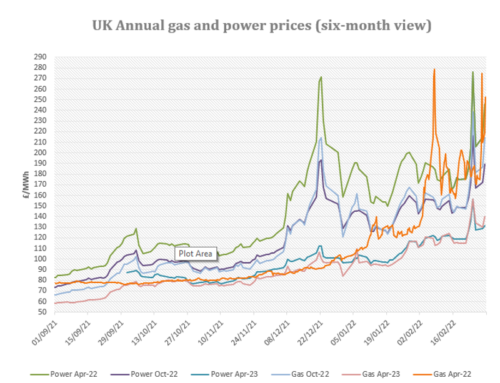

Electricity costs:

March opened with continued volatility amidst a market scrambling to understand how the Russian invasion of Ukraine was likely to impact on gas supply. Major spikes were seen as the market reacted to varying news reports with cease fire agreements made, yet attacks continued. Confirmation from Ukraine that they are unlikely to join NATO has seen a more positive response and talks now look set to take place with a 15-point plan reportedly drawn up for discussion.

Month ahead power reached significant high peaks during the first two weeks of March although this has somewhat settled with the market becoming cautiously confident that an agreement will be reached. That said, there is still likely to be severe reaction to individual news reports until peace is certain and volatility should continue to be expected.

The short-term market was boosted by lower renewable generation, with wind farms accounting for 27% of UK supply during the first fortnight – down from 36% over the previous two weeks – while the share of gas and coal generation rose from 25% to 34%. The UK also switched to net exporter to France following further nuclear capacity coming offline for maintenance.

The UK Day-ahead power Baseload index averaged £321/MWh over the first half of March – up a massive 83% compared to the prior fortnight – with the situation in Ukraine feeding bullish sentiment despite there being no material impact on European gas supply.

Outlook:

- More than 3 GW of French nuclear capacity was taken offline at three reactors on March 15th for long-term maintenance announced that day. At the St Laurent 2 reactor 915 MW will be unavailable until April 24th, 1.3 GW will be disconnected at Paluel 4 until June 26th and the 910 MW Bugey 3 will be closed until April 27th. Another 3.5 GW of French nuclear capacity is due to be taken offline this month for planned maintenance, according to the latest schedule from grid operator RTE. This may shore up export demand from the UK.

- The UK government is expected to announce new energy policies in the coming weeks designed to improve supply security, with a push towards supporting renewable and nuclear capacity expected. This followed an announcement earlier this month that the country would phase out imports of Russian oil – accounting for about 8% of the total – by the end of this year.

- The 857 MW Triton Knoll offshore wind farm is expected to start delivering power to the grid by the end of Q1 – according to RWE – after turbine commissioning was completed in January.

- UK power imports from Norway were up to an average of more than 1.2 GW after full capacity became available on the North Sea Link on March 15th, a rise of about 200 MW on average compared to the first 14 days of the month.

Gas costs:

UK gas prices roared up during the first week of March with April ’22 gas trading as high as 800 p/th at one point – a record by some margin for any period – before crashing lower when it became clear that immediate EU or UK sanctions on Russian energy exports were not on the table. Elevated flows from Russia, in addition to high numbers of LNG deliveries, helped to ease pricing.

One consequence of recent geopolitical events was that Summer-22 actually exceeded Winter-22 prices with concerns about supply having more affect on short-term rather than long term pricing. European Commission have proposed to mandate that gas storage sites in EU member states are 90% full by October 1st each year to ensure supply security. The practicality of this under review given that Gazprom owns capacity at several sites. Italy sets an example having achieved 85% heading into Q4 last year compared to an EU average of 75%.

Outlook:

- Wind farm generation is expected to average 6.7 GW through the remainder of the month – according to Elexon – down from an average of more than 8.4 GW across the winter period starting on October 1st last year. This should lift gas use from the power sector although mild temperatures are likely to keep a lid on the overall demand increase.

- The Netherlands will only lift output from the Groningen field as a measure of last resort as ministers announced a reduced production target for the gas year ending on September 30th of 4.6bcm – down from 7.6bcm announced in January – after which production will cease. Groningen produces low-calorific gas that is not used in the UK and the planned closure of the field later this year has been priced into mainland European markets.

- First gas has been delivered to the UK grid from the Blythe and Elgood fields, which are part of the Saturn Banks Project, according to producer IOG, which said it would provide an initial view on flow rates after stable production has been established.

- Norwegian gas exports are set to be boosted after producer Equinor secured permission from the government to increase output by 1.4bcm from now until September 30th. It will also be allowed to increase production from the giant Troll field by 1bcm in the event of issues at other sites.

Factors supporting Increases:

Gas storage – European storage volumes continue to be well below expected levels

French Nuclear Power – EDF has reduced its output forecast for 2023 and indicated further outages for maintenance likely resulting in a need to draw on UK supply

Russia/Ukraine Tensions – Although peace talks look more likely, the market could still react fairly dramatically to any negative news

Weather/Wind – Lower wind generation expected for the remainder of the month at an average of around 6.7 GW compared to 8.4 GW over the winter period.

Factors supporting decreases:

LNG –13 further LNG deliveries are expected by end March.

Russia/Ukraine Tensions – With peace talks look more likely we would expect to see market improvement although the market could still react fairly dramatically to any negative news

Weather / Wind – Although wind generation will be lower, warmer climates are likely to have a positive effect with less demand than the seasonal norm.

Read Eneco’s full market update here

Non-energy costs:

On the electricity side organisations will start seeing increases in pass through costs from both government and industry infrastructure providers due to pandemic-related demand destruction. Levies normally collected via unit rates have fallen short of expectations and have fed through to further increases in ROs, FiTs, EII and other transportation, distribution and renewable investment charges. In addition to this the Targeted Charging Review (TCR) is comes into effect from April 2022. Projections are available on our website via the links below.

Targeted Charging Review (TCR) electricity –

TCR is a change to both Distribution Use of System (DUoS) and Transmission Network Use of System (TNUoS) charges you will find within a supply contract.

-

- DUoS: changes coming into effect from April

-

-

- Paid to the associated distributor (DNO), the cost covers installation and maintenance of local distribution networks.

- Is expected to form part of the standing charge unless billed as an individual charge.

-

-

- TNUoS: changes in effect from 01/04/2023

-

-

- Paid to National Grid, the cost recovers the cost of installing and maintaining transmissions systems.

- At present, the charge is based on a meter’s share of demand on the network during 3 peak periods, known as Triads. These 3 Triad periods occur between 1st Nov to 28th Feb each year. It’s assessed during this time as demand on the grid is at its highest.

-

Historically these charges were based on volume used. It is felt that switching these to a fixed charge based on capacity and location will be a fairer and more consistent way to levy charges.

Is your organisation covered by the new Streamlined Energy and Carbon Reporting (SECR) scheme from the Environment Agency?

Designed to replace in part the Carbon Reduction Commitment (CRC) which ended in 2019 and to follow on from the energy savings recommendations generated by ESOS compliance. Note, SECR will cover a wider scope of organisations than CRC and ESOS do. SECR requires all large enterprises to disclose within their annual financial filing obligations to Companies House, their greenhouse gas emissions, energy usage (from gas, electricity and transportation as a minimum), energy efficiency actions and progress against at least one intensity ratio.

If your organisation qualifies, participation in this scheme is mandatory. Eneco Consulting are happy to provide assistance with your regulatory obligations. Full details are available on our website on the link below.

Are you eligible for an EII rebate?

Under current rules, if you qualify at an industry sector level and your business passes the 20% electricity intensity test you may qualify for exemption to CFD and RO charges. Please see the attached Government RO/CFD guidance document and update and give Abby a call on the main number to discuss this further.

Rolling 3-Year Gas and electricity prices to early March 2022

A copy of our environmental charges and Climate Change Levy rates from 2012 to date: Industry and Environmental Pass Through Charges including CCL p/kWh Updated 31082021

A copy of RO/CFD guidance document: RO_CFD_Guidance_Revised_July_2018

SECR: SECR EA Guidelines

TCR Charges (Targeted Charging Review this will be revised in November 2021 when Ofgem releases its review): TCR Charges (Targeted Charging Review) TNUOS bandings and Current Ofgem Costs now for 2023 onwards