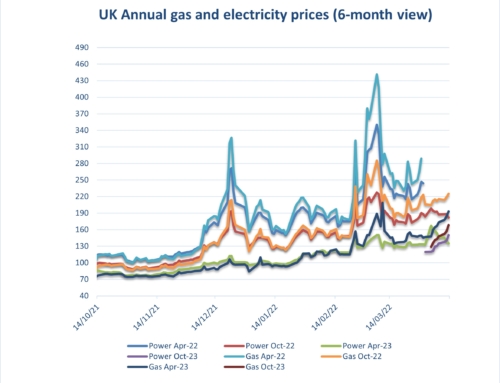

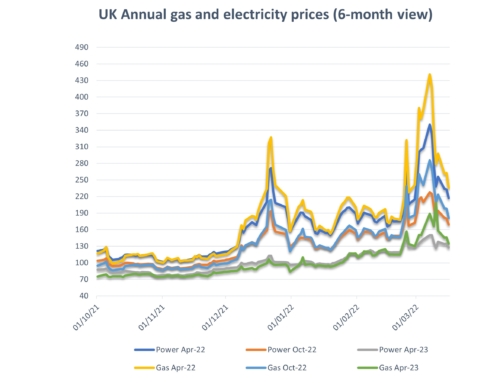

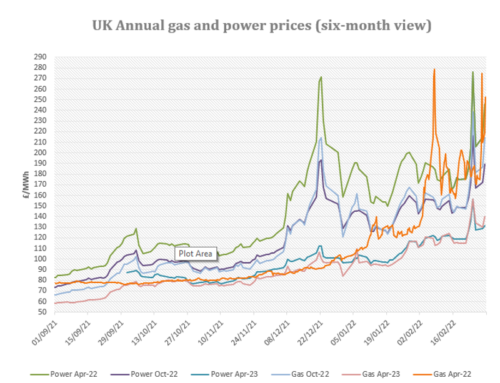

Energy costs: Both gas and electricity markets have been choppy over the last couple of weeks due to changeable weather patterns, competing pandemic concerns, and an increase in LNG deliveries to the UK following a sharp fall in prices on Asian markets. Saudi Arabian production cuts, low US crude inventories, and hopes of US economic stimulus package have all supported oil prices. Volatility on UK energy markets is expected to continue in the coming weeks with forecasts of an extended cold snap and supply outages likely to continue.

Upside:

Supply outages – The new interconnector between UK and France which came online on 22nd January has already suffered an outage. Further reliability issues could limit the UK’s import potential.

Oil markets – Further increases are possible as OPEC production cuts are ramped up in February and March.

Carbon costs – This has been increasing recently following resumption of EUA state auctions.

Weather – Weather forecasts have changed on almost a daily basis. However, very cold temperatures pushing in from the North-East are currently expected to cover much of the UK starting this weekend.

Downside:

LNG – There is a drop in Asian LNG prices due to their cold snap ending. This has been attracting more LNG deliveries into Europe and limited price rises on the UK markets.

BritNed Interconnector– This is now due to start operating next month following repairs enabling imports to resume.

Coal – Prices for coal have been come down to mid-December levels following limited buying interest from coal barge operators and traders with discussions of barge traffic bans on the Rhine continuing.

Could go either way:

Sterling – With agreement reached on Brexit, Sterling has strengthened against the Dollar and Euro limiting amplification of strengthened Oil and Carbon prices. Whether this continues will depend on the pace of the UK’s Covid-19 vaccination programme.

Lockdown – Gas and power demand have fallen with the continuing lockdown. Colder snaps may reverse this.

Non-energy costs:

On the electricity side organisations will see further increases in pass through costs from both government and industry infrastructure providers from 2022 onwards due to pandemic-related demand destruction. Levies normally collected via unit rates have fallen short of expectations and have fed through to further increases in ROs, FiTs, EII and other transportation, distribution and renewable investment charges. Targeted Charging Review will now take affect from April 1st 2022, one year later than expected, but are now being built into longer term contracts. Revised projections are available on our website via the links below.

Is your organisation covered by the new Streamlined Energy and Carbon Reporting (SECR) scheme from the Environment Agency?

Designed to replace in part the Carbon Reduction Commitment (CRC) which ended in 2019 and to follow on from the energy savings recommendations generated by ESOS compliance. Note, SECR will cover a wider scope of organisations than CRC and ESOS do. SECR requires all large enterprises to disclose within their annual financial filing obligations to Companies House, their greenhouse gas emissions, energy usage (from gas, electricity and transportation as a minimum), energy efficiency actions and progress against at least one intensity ratio.

If your organisation qualifies, participation in this scheme is mandatory. Eneco Consulting are happy to provide assistance with your regulatory obligations. Full details are available on our website on the link below.

Are you eligible for an EII rebate?

Under current rules, if you qualify at an industry sector level and your business passes the 20% electricity intensity test you may qualify for exemption to CFD and RO charges. Please see the attached Government RO/CFD guidance document and update and give Abby a call on the main number to discuss this further.

A copy of our detailed market report is available: Eneco Market Information early Feb 2021

Gas and electricity prices from 2009 to date are available here: Eneco Gas and Electricity Pricing Trends early Feb 2021

A copy of our environmental charges and Climate Change Levy rates from 2012 to date: Environmental Pass Through Charges and CCL with Definitions ppkWh 02.12.20

A copy of RO/CFD guidance document: RO_CFD_Guidance_Revised_July_2018

SECR: SECR EA Guidelines

TCR Charges (Targeted Charging Review): TCR Charges (Targeted Charging Review)