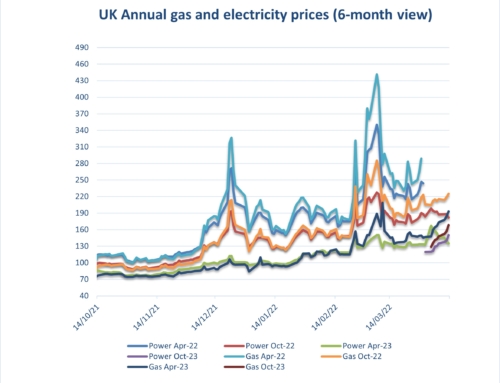

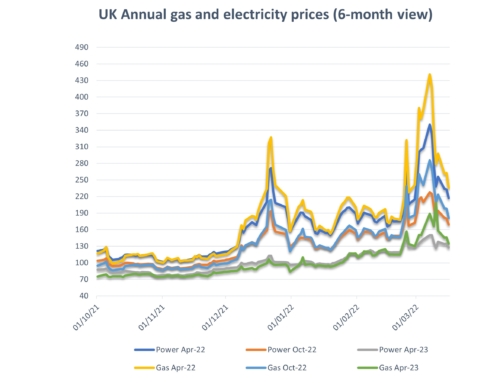

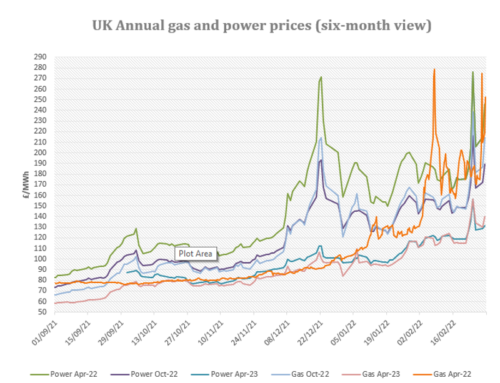

Energy costs: Market prices have bolstered up in the first half of August including short term gas prices rallying to 5 month highs due to low wind and nuclear output but continuing increasing demand in the country to the point we required the coal station to be switched on in the first time in 2 months. There is no sign of any reduction coming soon in the market as wind and nuclear output is expected to be minimal, low LNG deliveries into the country and maintenance in Norwegian fields expected to last until end of September.

Upside:

Maintainence – Maintenance ongoing until end of September in Norway and any further delays on the nuclear reactors at Dungeness and Hunterston B will push Winter pricing.

Demand – UK demand still increasing but starting to level out.

Oil markets – Oil markets have rallied up and are expected to continue.

Wind output – This is likely to remain low over the next fortnight with spells of moderate wind.

LNG – Asia’s increasing demand is taking priority for LNG cargoes and if this continues into Winter, there will be fewer deliveries heading to the UK and Europe.

Downside:

Gas storage – European gas storage sits at 89% fullness.

Weather – Unsettled weather for the next couple of weeks where temperatures will return to seasonal norms but should reduce the demand for cooling in the country.

Could Go Either Way:

Sterling – Brexit negotiations have returned to the news over the last fortnight. Problems in this area will feed through to exchange rates and impact energy prices.

Biomethane – Biomethane and hydrogen have just started to enter the UK gas network but it is seen as a way to help reduce the UK’s carbon footprint.

Non-energy costs:

On the electricity side organisations will see further increases in pass through costs from both government and industry infrastructure providers in the coming months as distribution, Electricity Market Reform (EMR),Capacity Market and Energy Intensive Industries (EII) charges are ramped up. Revised non-energy cost predictions are expected in July – delayed by the pandemic.

Climate change levy (CCL) again change on April 1st. Please see the attached pass through charge information for details. Your CCA related CCL exemption rates will change at the same time (Gas to 81%, Electricity to 92%). Please ensure your PP11 forms are updated and sent through.

Is your organisation covered by the new Streamlined Energy and Carbon Reporting (SECR) scheme?

Designed to replace in part the Carbon Reduction Commitment (CRC) which ends this year and to follow on from the energy savings recommendations generated by ESOS compliance. Note, SECR will cover a wider scope of organisations than CRC and ESOS do. Full details are attached below.

SECR will require all large enterprises to disclose within their annual financial filing obligations to Companies House, their greenhouse gas emissions, energy usage (from gas, electricity and transportation as a minimum), energy efficiency actions and progress against at least one intensity ratio.

The scheme came into effect on April 1st, 2019 and will be required to be included in the first set of accounts published for financial years starting after this date.

The scheme covers publicly quoted companies (extending their current disclosure requirements) and UK incorporated companies or LLPs with two or more of the following.

- More than 250 employees

- A turnover in excess of £36 million

- A balance sheet in excess of £18 million.

UK subsidiaries, who meet the eligibility criteria, but are covered by a parent group’s report (unless the parent group is registered outside the UK) and companies using less than 40,000 kWh of energy during the reporting year do not have to provide disclosure. Note the reporting year should be aligned to your financial year.

Are you eligible for an EII rebate?

Under current rules, if you qualify at an industry sector level and your business passes the 20% electricity intensity test you may qualify for exemption to CFD and RO charges. Please see the attached Government RO/CFD guidance document and update and give Abby a call on the main number to discuss this further.

A copy of our detailed market report is available: Eneco Market Information mid August 2020

Gas and electricity prices from 2009 to date are available here: Eneco Gas and Electricity Pricing Trends Sept 2009 to mid August 2020

A copy of our environmental charges and Climate Change Levy rates from 2012 to date: Environmental Pass Through Charges and CCL ppkWh Updated 21.07.20

A copy of RO/CFD guidance document: RO_CFD_Guidance_Revised_July_2018

SECR: SECR EA Guidelines